Imagine cooking and baking every day as a passion. Slowly cultivating your passion into your work and livelihood. Starting with ~ Rs 20,000, Mrs Rajni Bector, started the company, Mrs Bectors Food Specialities Ltd (MBFSL) which is now a ~ Rs. 2400 cr mcap publicly listed company.

It’s nothing short of commendable that Mrs Rajni Bector is now running two of the most well known brands in the biscuit and bread/bakery segment - Cremica and English Oven.

In this deep dive we will explore the business of MBFSL. I will take you through

Outlook of the Industry MBFSL operates In

The Competitive Landscape

MBFSL’s business

Competitive Advantage

Financials of the company

Risks

Conclusion

Indian Biscuits and Bakery Market

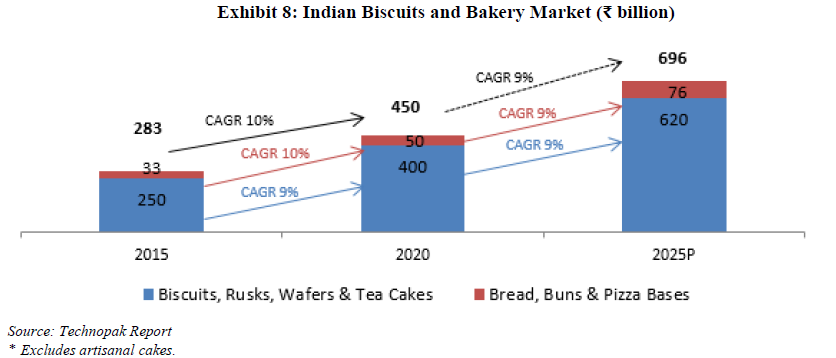

The Indian biscuits and bakery retail market is valued at ₹ 450.00 billion and is expected to grow at a CAGR of ~9% over the next five years. Biscuits and other snacking bakery products such as rusks, wafers and tea cakes contribute almost ₹ 400.00 billion or 89% to the total market.

The balance 11% is contributed by breads including loaves, buns, pizza bases which together account for ₹ 50.00 billion.

The Indian biscuit market size represents about ~5% of the global market. Indian market is expected to grow at a CAGR of 9% till 2025 and reach ₹ 620.00 billion. This growth will increase India’s share in the global market to ~6% by 2025

The main reasons for the growth are:

Higher disposable income

Changing Lifestyle - People prefer ‘healthier’ options now

Availability of products - Due to constant innovation and changes in taste and preferences, there are a lot of products available. For example, biscuits can further be divided into: (i) Cookies; (ii) Cream; (iii) Crackers (salty and nonsalty); (iv) Marie; (v) Digestive.

Affordability

Per capita biscuit consumption of biscuits in India has increased by 16% over the last five years. However, it is far behind developed economies like US, UK and other developing Asian economies like Japan and Sri Lanka. Though there is huge headroom for growth in India for biscuit market:

Similarly, the bakery segment as well is facing several tailwinds.

With ~5% market share (as on FY20), the premium category is to grow at ~15% CAGR for the next 5 years.

The main reasons for this growth are:

QSRs’ themselves are guiding double-digit growth (end-user)

Introduction of new product variants such as English Oven Sub

Increasing disposable income

Increased in-house consumption

Indian Biscuits and Bakery Market

The key players in the biscuit segment are: Britannia, Parle, Anmol and ITC among many more manufacturers.

The value chain of biscuits is quite straightforward, as depicted below:

In the industry players like Britannia and Parle use a combination of in-house manufacturing and outsourced model to fulfill their demand. MBFSL operates with 100% in-house manufacturing for its product to command higher margins.

It’s clear that no industry leader has adopted the complete outsourcing model. The benefits of in-house manufacturing provides these leaders to leverage the export opportunity. It is so because in-house manufacturing provide better visibility and control on quality assurance and food safety standards and faster product development cycles.

The market is favorable for new entrants as companies usually see what the competitors are doing and then find a better way to produce and market those biscuits. However, the biggest challenge in this kind of industry is that to set up a plant and especially take it in-house, the capital needed is quite a large amount. This acts as somewhat of an entry barrier.

The key players in the bakery segment are: Britannia, Bonn, and Harvest Gold among many more manufacturers.

India's bread market is projected to grow at over 10% due to the growth factors mentioned above.

Mass bread segment primarily comprises of white/sandwich bread made up of refined wheat flour (maida).

Premium bread segment has emerged over the last 15 years. This comprises of products related to health and wellness such as fortified white breads, whole wheat/brown or alternative grain variants of breads, milk and fruit breads and specialty products such as pizza bases, burger buns and hot dog buns. Breads are sold in packaged and pre-sliced loaf forms with 350 gms and 400 gms as most common pack sizes.

The super-Premium bread segment comprises of exotic and speciality breads such as pita bread, focaccia, ciabatta bread and sour dough breads

Among these, the White Bread segment accounts for the largest market share. However, the brown bread segment is expected to grow at a faster rate as an increasing number of consumers are getting more inclined towards eating bread which is made up of 100% wheat.

MBFSL’s Business

MBFSL is one of the leading companies in the premium and mid-premium biscuits segment and the premium bakery segment in North India.

They manufacture and market a range of our biscuits such as cookies, creams, crackers, digestives and glucose under our flagship brand ‘Mrs. Bector’s Cremica’.

MBFSL also manufactures and markets bakery products in savoury and sweet categories which include breads, buns, pizza bases and cakes under our brand ‘English Oven’.

Facilities

All our products are manufactured in-house at our six manufacturing facilities located in Phillaur and Rajpura (Punjab), Tahliwal (Himachal Pradesh), Greater Noida (Uttar Pradesh), Khopoli (Maharashtra) and Bengaluru (Karnataka), which enables us to have an effective control over the manufacturing process and to ensure consistent quality of our products. All our manufacturing facilities are strategically located in proximity to our target markets, which minimises freight and logistics related time and expenses

MBFSL is expanding in the southern and western markets via a Hub and spoke model (similar to one diagnostic companies use). They are targeting the Metro markets of Mumbai/Pune and Bangalore, where purchasing power is high and can be beneficial to them as their target market is mid-premium to premium. A plant can usually service around 300 Km area around it and by putting up this new capacity, they can service these markets.

Competitive Advantage

“Moat”s are very subjective. But if a stock has a moat and the entire industry and end-user industry are going through tailwinds, its definitely worth a look.

“A good business is like a strong castle with a deep moat around it. I want sharks in the moat. I want it untouchable”

-Warren Buffett

In my opinion, the major moat here is the fact that they spent the extra capital and brought the entire production in-house. In-house 100%. This shows you their commitment to quality. MBFSL is the largest bun supplier to leading QSR customers such as Burger King India, Connaught Plaza Restaurants, Hardcastle Restaurants, and Yum! Restaurants (India). It has stayed the preferred supplier of burger buns and pan muffins (fresh) for Hardcastle Restaurants since 2007.

Recently they got a really big, new account, Subway.

Having everything in-house where quality is maintained throughout the entire process, has helped Bector build these long-lasting relationships with leading QSR names and get add more accounts.

Financials

Won’t touch up too much on this however a few thoughts:

MBFSL has an EBITDA margin of 10-11%, which has been under pressure due to input cost pressures. This should improve as the company passes on the cost increases and increases the proportion of the B2C segment. In addition, input cost pressure is easing up. Management expects to grow top line at 18-20% for next few years and EBITDA margins to sustain at 13-14%.

Right now MBFSL is trading at 48x P/E and 19.5x EV/EBITDA.

Risks

MBFSL can’t use the brand name “Mrs Bectors Cremica” due to a family dispute. They will need to spend more in marketing and creating brand awareness. The risk being that it will technically be a new brand and you will not know the response of the audience.

It is a capital-intensive industry, and to keep growing you will have to infuse more capital

Management is new as the IPO was recent. The growth/ expansion plans are aggressive. Execution is one to watch.

Conclusion

Having decades of experience and an established brand name, MBFSL, is now in its growth phase. In my opinion, they are embarking on a growth strategy by expanding distribution into other parts of the country.

They are doing this by setting up new plants and aggressively increasing their distribution network. Hand in hand they are strengthening corporate governance by adding senior-level management to keep execution in check. I think the company can grow 15%+ in the coming few years.

What excites me about MBFSL is the proxy to QSR sector. I am a victim to late night indulgence of McDonalds and Burger King. And see it all around me that as Zomato and Swiggy have made it easy to get food to our doorstep, MBFSL products will be getting delivered to your doorstep.

See you in the next one.

Please let me know what you guys think about this one!